Get In On Kim’s Big Johnson College Bowl Mania!!!

Get In On Kim’s Big Johnson College Bowl Mania!!!

You know if it has three (!!!) exclamation points, and is written in red, it’s gotta be good.

This contest involves choosing the winning team for each of the 34 (yes, now it’s 34!) upcoming college football Bowl Games, to be played between December 20 and January 8. In addition to choosing the winning teams, you have to assign a Confidence Points factor of 1 to 34 to each game – your personal view of how certain you are of the outcome of each game. If you have high confidence in your choice, you give that game a high value; conversely, if you have no idea which team might win, you would assign a low value. If the team you pick wins, you get the points you assigned. For a tiebreaker, you have to guess the score of the BCS Championship game.

The contest will feature a small prize of some sort – probably involving chocolate – to everyone who beats me, and an engraved 8GB iPod Nano (your choice of color) to the top scorer. Second prize is a 1 pound tin of Mrs. Hanes Moravian Sugar Crisp Cookies. Mmmmmmm . . .

The contest will feature a small prize of some sort – probably involving chocolate – to everyone who beats me, and an engraved 8GB iPod Nano (your choice of color) to the top scorer. Second prize is a 1 pound tin of Mrs. Hanes Moravian Sugar Crisp Cookies. Mmmmmmm . . .

If your entry is really hot, you might win something from ESPN, too, but who cares? The Big Johnson is special!

You enter the contest by going to the ESPN website and follow the instructions below. There is no cost. You are welcome to invite your friends – any friend of yours is a friend of mine.

Let me know if you have any other questions.

How To Play College Bowl Mania the Big Johnson Way

Step 1 – REGISTRATION

To enter, fill out the free game registration at the ESPN website. A valid ESPN member name and password will be used as an identifier to sign in to game play, and to keep track of your entry’s score and standing. If you are already a registered ESPN account holder, you do not need to go through the registration process. If you’ve had an ESPN account in the past but forgot your password, visit Member Services and have your account information sent to you.

Step 2 – GAME SETTINGS

After you have signed in, you will be prompted with a screen with a “Create Entry” button. After you click on the button you will be automatically redirected to the “Entry Settings” page where you will be asked to name your entry and decide whether you would like email reminders.

- Name your entry: Use the text box to determine how your entry will be displayed in the game. Use your imagination. Please.

- Scoring system: Use the radio buttons to select Confidence Points (required for our game).

- Email Reminders: Use the radio buttons to select whether or not you’d like to receive email reminders from ESPN pertaining to game locks and game rules. I will send emails through the ESPN system to the participants about the game, so be sure to read the email account you use to register!

Once you have completed your game settings, click on the “Submit Entry Settings” button.

Step 3 – JOINING THE BIG JOHNSON GROUP

To join the Big Johnson group after you submit your entry settings, click on the words Create Or Join A Group. Search for the group named Big Johnson, and join the group using the password, “kimsentme” (get it? Kim Sent Me?). You can join the group as soon as you create your entry – you don’t have to make any picks first. Let me know if you have any problems getting into the group.

Step 4 – MAKING YOUR PICKS

You won’t be able to make your picks for the games until all the bowl game contestants are known – probably by Wednesday, December 10. Then you will be able to pick your winner for each game, and predict the final team scores of the National Championship Game as the game’s primary tiebreaker. To select the team you think will win, click on the table cell containing the team name or the checkbox next to the team name. Once you’ve made all of your picks, you can “click and drag” the game up or down in the list to change the assigned Confidence Value for that game. The higher the confidence you assign to a bowl game, the more points you will earn if you have selected the winning team. Each game must have a different confidence value assigned to it from 1 to 34. To predict the final team scores of the National Championship Game, enter your predictions in the fields designated as “Score Guess.” Once satisfied with your selected picks, the confidence values for those picks, and the championship game’s score guess, click the “Submit Your Picks” button to enter them.

Register and submit your entry no later than the first kickoff of the first game of the college football bowl season (Saturday, December 20, 2008 at 11:00 am ET) at which point the game will lock and no additional picks can be made. If you change your mind about a game, you can go back and change your picks until the first game starts.

Step 5 – SCORING

In the Confidence scoring system, the higher the confidence you assign to a game, the more points you will earn if you have selected the winning team. If your chosen team wins, you get the points you assigned to that game. You do not lose points for incorrect picks.

Step 6 – JOINING ANOTHER GROUP

You can join up to three (3) different groups with the same entry, not that you will give a hoot. Once you have enjoyed the Big Johnson, all the others are, well, kinda puny. Each user may have up to three (3) different entries – but only ONE entry in the Big Johnson.

Cell: 703-861-9234 • Fax: 703-896-5055 • Email: KimTheAgent@gmail.com

Cell: 703-861-9234 • Fax: 703-896-5055 • Email: KimTheAgent@gmail.com

Posted by Kim Hannemann

Posted by Kim Hannemann

Just in time for the annual Spring Home Buying Season, Fannie Mae and Freddie Mac are expected to begin filling the store shelves with a brand-new stock of foreclosed homes. Without fanfare, on March 31 they both ended the

Just in time for the annual Spring Home Buying Season, Fannie Mae and Freddie Mac are expected to begin filling the store shelves with a brand-new stock of foreclosed homes. Without fanfare, on March 31 they both ended the  Today’s [4/21] Washington Post is actually kind of fat for a Tuesday edition. Then you realize that it sports a rather hefty Classified ads section. The “G” section is a solid 20 pages. But, almost all of it is real estate property foreclosure public notices. They start on page G1 and staggeringly run to page G19. They take up almost as much space as the 24-page “A” news and business section. However, employment ads take up less than one column on G19.

Today’s [4/21] Washington Post is actually kind of fat for a Tuesday edition. Then you realize that it sports a rather hefty Classified ads section. The “G” section is a solid 20 pages. But, almost all of it is real estate property foreclosure public notices. They start on page G1 and staggeringly run to page G19. They take up almost as much space as the 24-page “A” news and business section. However, employment ads take up less than one column on G19. March 2009 home sales activity for Fairfax and Arlington counties and the cities of Alexandria, Fairfax and Falls Church and the towns of Clifton, Herndon and Vienna (this sounds like a weather alert, doesn’t it?):

March 2009 home sales activity for Fairfax and Arlington counties and the cities of Alexandria, Fairfax and Falls Church and the towns of Clifton, Herndon and Vienna (this sounds like a weather alert, doesn’t it?):

February 2009 home sales activity for Fairfax and Arlington counties, the cities of Alexandria, Fairfax and Falls Church and the towns of Vienna, Herndon and Clifton:

February 2009 home sales activity for Fairfax and Arlington counties, the cities of Alexandria, Fairfax and Falls Church and the towns of Vienna, Herndon and Clifton:

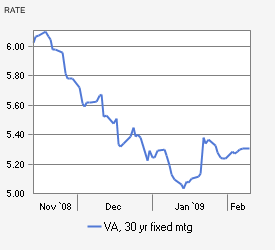

Looking at the January 2009 data for the housing market in Northern Virginia (Fairfax and Arlington Counties; Falls Church, Fairfax and Alexandria Cities), the year-over-year trends of the past several months are continuing – sales are up (+39%), active listings are down (-16%), pending sales are up (+23%) and sales prices continue to run 20-25% below those of a year ago, and -30% from two years ago. Average days on market is declining but is still in the 100 range (for sold homes).

Looking at the January 2009 data for the housing market in Northern Virginia (Fairfax and Arlington Counties; Falls Church, Fairfax and Alexandria Cities), the year-over-year trends of the past several months are continuing – sales are up (+39%), active listings are down (-16%), pending sales are up (+23%) and sales prices continue to run 20-25% below those of a year ago, and -30% from two years ago. Average days on market is declining but is still in the 100 range (for sold homes). Detached Homes for sale under $300,000:

Detached Homes for sale under $300,000:

The contest will feature a small prize of some sort – probably involving chocolate – to everyone who beats me, and an engraved 8GB iPod Nano (your choice of color) to the top scorer. Second prize is a 1 pound tin of Mrs. Hanes Moravian Sugar Crisp Cookies. Mmmmmmm . . .

The contest will feature a small prize of some sort – probably involving chocolate – to everyone who beats me, and an engraved 8GB iPod Nano (your choice of color) to the top scorer. Second prize is a 1 pound tin of Mrs. Hanes Moravian Sugar Crisp Cookies. Mmmmmmm . . .