The other day, I was out with a first-time buyer client and blathering on about cherry trees, house styles and what have you when she stopped me cold with a very important question I couldn’t answer right away:

The other day, I was out with a first-time buyer client and blathering on about cherry trees, house styles and what have you when she stopped me cold with a very important question I couldn’t answer right away:

“In your experience, how much should we budget for maintenance?”

It’s a great question. And not easily answered. “That depends!” is an answer of sorts, and it’s true, but not helpful. I Googled “home maintenance costs” when I got home, and from the usual 2,456,871 hits, I managed to sort out a few useful nuggets.

So, Jennifer, here are a whole bunch of great sources you can use to try to budget for maintenance:

Life Expectancy of Home Components is a 2007 study from the National Association of Home Builders, sponsored by Bank of America. It has a lot of good information on you guessed it, components and systems of a typical home, occupied by a typical family with 1.8 children no doubt.

Life Expectancy of Home Components is a 2007 study from the National Association of Home Builders, sponsored by Bank of America. It has a lot of good information on you guessed it, components and systems of a typical home, occupied by a typical family with 1.8 children no doubt.

Among the findings of the study:

- Appliances. Of the major appliances in a home, gas ranges have the longest life expectancy, at 15 years. Dryers and refrigerators last about 13 years. Appliances with the shortest life spans are: trash compactors (six years), dishwashers (nine years) and microwave ovens (nine years). Some appliances don’t meet their life expectancy, however, because changes in styling, technology and consumer preferences may make newer products more desirable. Also, how long they last depends on how much they are used. [Duh.]

- Decks. The life span of these can vary significantly according to different climates, but they should be around for a good 20 years under ideal conditions.

- Faucets and Fixtures. Kitchen sinks made of modified acrylic will last 50 years, faucets will work properly for about 15. Bathroom shower enclosures can stick around for 50 years, although the shower doors could be in a serious state of decline in about 20 years. Showerheads last a lifetime, as will toilets, although tank components require some maintenance. The durability of whirlpool tubs ranges fairly widely – from 20 to 50 years – depending on use.

- Flooring. All natural wood flooring, and marble, slate and granite will last for 100 years if they are well taken care of. Vinyl floors will endure for up to 50 years, linoleum about 25 years and carpet between eight and 10 years, depending on traffic and care.

- Garages. Garage doors last 10 to 15 years, and light inserts for 20.

- Home Technology. A built-in audio system will last 20 years, but security systems and heat and smoke detectors will only be around for five to 10. Wireless home networks and home automation systems are expected to work properly for more than 50 years.

- Heating, Venting and Air Conditioning. HVAC systems need proper and regular maintenance in order to work, but even when they are pampered most of their components last only 15 to 25 years. Furnaces live for 15 to 20 years, heat pumps for up 16 years, and air conditioning 10 to 15. Tankless water heaters last more than 20 years, while an electric or gas water heater has a life expectancy of about 10 years. Thermostats usually are replaced before the end of their 35-year life span because of technological improvements.

- Paints, Caulks and Adhesives. Interior and exterior paints can last for 15 years or longer, although home owners tend to repaint more often.

- Roofing. Slate, copper and clay/concrete roofs have a 50-year life expectancy; asphalt-shingle roofs, 20 years; fiber cement shingles, 25 years; and wood shakes, 30 years. However, the life of a roof depends on local weather conditions, proper building and design, material quality and adequate maintenance.

- Siding and Accessories. Outside materials typically last a lifetime. Brick, engineered wood, both natural and manufactured stone and fiber cement will last as long as the house. Exterior wood shutters are expected to last 20 years, depending on the weather. Gutters made of copper can last 50 years, of aluminum, 20. Copper downspouts last 100 years or more; aluminum, 30 years.

- Windows and Skylights. Aluminum windows last between 15 and 20 years, while wooden windows can last upwards of 30 years.

Home Tech offers an interactive Remodeling Cost Estimator that generates an estimate of your remodeling project based on regional cost and pricing information. You enter your zip code and select from a variety of project types. The estimator then takes you through a series of questions about measurements, quality level of components, and so on, before delivering a dollar amount that in my estimation was on the high side. Your mileage may vary.

Home Tech offers an interactive Remodeling Cost Estimator that generates an estimate of your remodeling project based on regional cost and pricing information. You enter your zip code and select from a variety of project types. The estimator then takes you through a series of questions about measurements, quality level of components, and so on, before delivering a dollar amount that in my estimation was on the high side. Your mileage may vary.

My friends at US Inspect give us US Inspect House Facts, a great resource for learning about all that stuff in your house you currently know nothing about, and how to maintain and even repair much of it yourself. It’s a terrific one-stop home information resource.

My friends at US Inspect give us US Inspect House Facts, a great resource for learning about all that stuff in your house you currently know nothing about, and how to maintain and even repair much of it yourself. It’s a terrific one-stop home information resource.

Lastly, I can strongly recommend a home warranty for those of you who want good control of your budget and relative peace of mind when it comes to major home repair costs. A home warranty is a service contract that covers the repair or replacement of many of the most frequently occurring breakdowns of home system components and appliances. I always arrange to get a home warranty for my buyers, and try to have my sellers offer one to reassure prospective buyers. It’s a no-brainer.

Lastly, I can strongly recommend a home warranty for those of you who want good control of your budget and relative peace of mind when it comes to major home repair costs. A home warranty is a service contract that covers the repair or replacement of many of the most frequently occurring breakdowns of home system components and appliances. I always arrange to get a home warranty for my buyers, and try to have my sellers offer one to reassure prospective buyers. It’s a no-brainer.

Most home warranties cover your home’s air conditioning system, central heating unit, ductwork, electrical system, ceiling fans, plumbing system, water heater, refrigerator, built-in dishwasher, built-in microwave, oven/range, garbage disposal, built-in trash compactor, washer, dryer and more.

How it works: the homeowner calls the warranty company, who arranges for the service call. The homeowner pays a service call fee – from $50 to $100 depending on the policy – but repairs and/or replacement (company’s decision) of the broken item are covered.

The most common complaints about these policies are that they don’t let you choose your own service company, and they occasionally question whether the problem was pre-existing (i.e., the appliance was broken before coverage was purchased). A recent report from a recognized home inspection service is usually accepted as proof to the contrary, if necessary.

There are several reputable home warranty companies who offer policies in Northern Virginia. Costs range from $350 to $500 per year, depending on coverage and deductibles. Try AHS – who has good home maintenance tips on the website; 2-10; or HMS.

If all else fails, try humor. I recommend Dave Barry – either The Taming of the Screw (hilarious illustrations by Jerry O’Brien) or Homes and Other Black Holes, illustrated by the late Jeff MacNelly.

If all else fails, try humor. I recommend Dave Barry – either The Taming of the Screw (hilarious illustrations by Jerry O’Brien) or Homes and Other Black Holes, illustrated by the late Jeff MacNelly.

Kim Hannemann, Real Estate Consultant/Realtor®, Samson Realty

Cell: 703-861-9234 • Fax: 703-896-5055 • Email: KimTheAgent@gmail.com

It’s Good To Have A Friend In The Business®

If you would like to discuss real estate questions, sell or buy a home in Northern Virginia – including Alexandria, Annandale, Arlington, Burke, Centreville, Chantilly, Clifton, Fairfax, Fairfax Station, Falls Church, Kingstowne, Lorton, McLean, Reston, Springfield, or Vienna – contact Kim today.

4 – 4.5% Listings with First-Class Service — Cash Back to My Buyers!

Real Estate Consultant/Realtor

Cell: 703-861-9234 • Fax: 703-896-5055

Email: KimTheAgent@gmail.com

It’s Good To Have A Friend In The Business®

Real Estate Consultant/Realtor

Cell: 703-861-9234 • Fax: 703-896-5055

Email: KimTheAgent@gmail.com

It’s Good To Have A Friend In The Business®

Posted by Kim Hannemann

Posted by Kim Hannemann  From agent

From agent  Saturday’s

Saturday’s

The other day, I was out with a first-time buyer client and blathering on about cherry trees, house styles and what have you when she stopped me cold with a very important question I couldn’t answer right away:

The other day, I was out with a first-time buyer client and blathering on about cherry trees, house styles and what have you when she stopped me cold with a very important question I couldn’t answer right away:

Lastly, I can strongly recommend a home warranty for those of you who want good control of your budget and relative peace of mind when it comes to major home repair costs. A home warranty is a service contract that covers the repair or replacement of many of the most frequently occurring breakdowns of home system components and appliances. I always arrange to get a home warranty for my buyers, and try to have my sellers offer one to reassure prospective buyers. It’s a no-brainer.

Lastly, I can strongly recommend a home warranty for those of you who want good control of your budget and relative peace of mind when it comes to major home repair costs. A home warranty is a service contract that covers the repair or replacement of many of the most frequently occurring breakdowns of home system components and appliances. I always arrange to get a home warranty for my buyers, and try to have my sellers offer one to reassure prospective buyers. It’s a no-brainer. If all else fails, try humor. I recommend Dave Barry – either The Taming of the Screw (hilarious illustrations by Jerry O’Brien) or Homes and Other Black Holes, illustrated by the late Jeff MacNelly.

If all else fails, try humor. I recommend Dave Barry – either The Taming of the Screw (hilarious illustrations by Jerry O’Brien) or Homes and Other Black Holes, illustrated by the late Jeff MacNelly. Yesterday I took a mini-vacation – I went about a mile from my home to take photos in Daventry. Late April, when the azaleas and dogwoods are blooming, is a great time to visit any Northern Virginia community, but Daventry is special, even on trash day. Everywhere I turned there were photo opps.

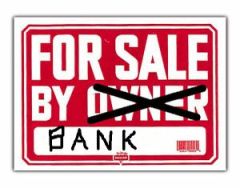

Yesterday I took a mini-vacation – I went about a mile from my home to take photos in Daventry. Late April, when the azaleas and dogwoods are blooming, is a great time to visit any Northern Virginia community, but Daventry is special, even on trash day. Everywhere I turned there were photo opps. Just in time for the annual Spring Home Buying Season, Fannie Mae and Freddie Mac are expected to begin filling the store shelves with a brand-new stock of foreclosed homes. Without fanfare, on March 31 they both ended the

Just in time for the annual Spring Home Buying Season, Fannie Mae and Freddie Mac are expected to begin filling the store shelves with a brand-new stock of foreclosed homes. Without fanfare, on March 31 they both ended the  Today’s [4/21] Washington Post is actually kind of fat for a Tuesday edition. Then you realize that it sports a rather hefty Classified ads section. The “G” section is a solid 20 pages. But, almost all of it is real estate property foreclosure public notices. They start on page G1 and staggeringly run to page G19. They take up almost as much space as the 24-page “A” news and business section. However, employment ads take up less than one column on G19.

Today’s [4/21] Washington Post is actually kind of fat for a Tuesday edition. Then you realize that it sports a rather hefty Classified ads section. The “G” section is a solid 20 pages. But, almost all of it is real estate property foreclosure public notices. They start on page G1 and staggeringly run to page G19. They take up almost as much space as the 24-page “A” news and business section. However, employment ads take up less than one column on G19. March 2009 home sales activity for Fairfax and Arlington counties and the cities of Alexandria, Fairfax and Falls Church and the towns of Clifton, Herndon and Vienna (this sounds like a weather alert, doesn’t it?):

March 2009 home sales activity for Fairfax and Arlington counties and the cities of Alexandria, Fairfax and Falls Church and the towns of Clifton, Herndon and Vienna (this sounds like a weather alert, doesn’t it?):

Another factor that could impact whether mortgage rates see significant improvement are concerns of future inflation brought on by all the recent aggressive moves by the Fed. While we know there is little inflation at the present time, chatter about future inflation could have a negative impact on home loan rates, or at least stifle any improvements.

Another factor that could impact whether mortgage rates see significant improvement are concerns of future inflation brought on by all the recent aggressive moves by the Fed. While we know there is little inflation at the present time, chatter about future inflation could have a negative impact on home loan rates, or at least stifle any improvements.